Model at AI speed.

Move with conviction.

The workspace where deals model themselves.

New York / Copenhagen

The workflow

From documents to decisions.

Extract

Documents become data. Every value linked to its source.

Model

Readable formulas. Automatic dependencies. Full history.

Export

Excel, PDF, or API. Provenance travels with the model.

Model at the speed of AI

Documents in. Model out.

The Henry & The Jimmy

Acquisition Model — Multifamily

42-unit multifamily portfolio. Asking price $47,000,000. Model includes 10-year cash flow projection with sensitivity analysis.

Portfolio

| # | Name | NOI | Asking Price |

|---|---|---|---|

| Portfolio | |||

| 1 | The Henry | ||

| 1.1 | 1BR Units (×8) | ||

| 1.2 | 2BR Units (×12) | ||

| 1.3 | 3BR Units (×4) | ||

| 2 | The Jimmy | ||

| 2.1 | Studio Units (×6) | ||

| 2.2 | 1BR Units (×8) | ||

| 2.3 | 2BR Units (×4) |

Negotiation Assumptions

4 fieldsCore inputs that drive the model

Calculated Outputs

3 fieldsOne source of truth

Change the model. Update everything.

Update once. Propagate everywhere.

Where Precurion fits

From first look to final close.

GP screens 50 deals in a quarter

Same-daygo/no-go

Comps pulled across 12 markets

15 minutesto comp set

200-unit rent roll structured

Under an hourto clean data

40-property portfolio modeled

Every celltraced to source

6 scenarios run before IC

Instantwhat-ifs

LP question on IRR answered

Full trailacross 3 funds

Customer Stories

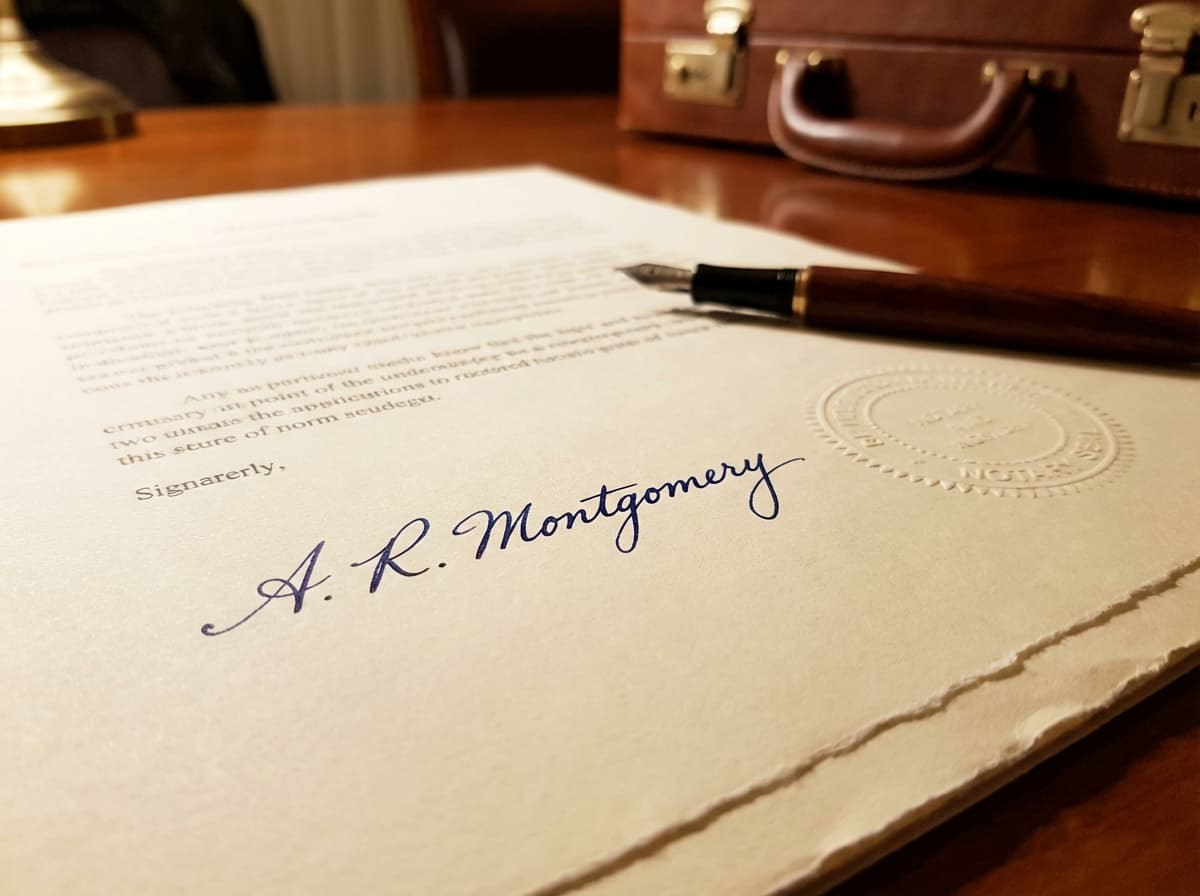

Ian Smith

CEO and Founder

Keeps Sports

We're modeling complex deals in days instead of weeks and generating legal docs that would've taken months. For fast-moving startups like Keeps, Precurion is essential.

Keeps structures equity and debenture deals with both teams and leagues and Precurion's AI platform allows them to respond same day to customer model and documentation requests impossible 6 months ago.

4h

→ 45 min

Avg. underwriting time

+20

More Clients Pitched Q4

With Precurion Models

100%

Traceable

Every value to source

5X

Faster

IC decision cycle

More customer stories coming soon

Institutional memory

Your edge, compounding.

Every deal teaches Precurion how your firm thinks. Your judgment, encoded.

Every deal, banked

What you learned on deal one shows up on deal 100.

Outcomes, predicted

Based on your history, not industry averages.

Never start from zero

Ten analysts. One memory.